Do citizens have a say in what happens in their community? To their tax dollars?

Cleveland Heights City Council has asked the Board of Education to approve an 11yr 80% tax abatement to a developer to build on Meadowbrook-Lee.

Cleveland Heights City Council plans to further subsidize this plan by GIVING the developer the acre of land to build on.

Land that taxpayers spent $1 million to purchase, demolish buildings and remediate.

On July 17 Orlean Company made a presentation to the Board of Education, asking for this tax abatement. I have attached the presentation here: Meadowbrook-Lee Project 2012

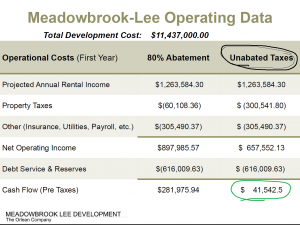

I have also extracted page 23 from the Orlean document that shows, with their own numbers, that they do not need the abatement to make the project work.

- Debt service.

- Reserve fund (money put away for a rainy day).

- The entire unabated tax bill.

They have demonstrated no need for any abatement of any size.

Or for “donated land”.

Do citizens have a say in this proposed transfer of public funds and property to a private entity?

Don’t we need all the revenue for our schools that we can get?

Why should we all have to make up for the taxes this development will not have to pay?

Don’t we need a community forum on this issue? Let’s make this decision after all the facts have been presented and we have had an opportunity to talk about this together.

I hope Future Heights will provide a community forum on the Meadowbrook-Lee project; they have a track record of making wonderful contributions to increasing citizen participation.

I ask that they do this for our community once again.

Here is a suggestion for a working title for this important forum:

Tax abated projects: Do citizens have a say in what happens to their tax dollars in their community?

______________________________________________

P.S. If you want the Board of Education to know how you feel about tax-abating Meadowbrook-Lee to the tune of $3 million, you can reach them with the contact information provided here.

Fran makes some good points, and the Heights Observer blogs are a great place to have this discussion.

In regards to the request for a public forum, FutureHeights will have to determine if it has both the time and the resources to put together a comprehensive and balanced forum on this topic. The CH-UH Board of Education may make a decision on this within the next couple of weeks, which gives little time to assemble expert panelists, find a location and publicize the event.

A small organization like ours has to be careful of over-committing, which is why we focus on creating tools that help members of the community express their views and provide information to the greater community. Such tools include the Heights Observer, where writing an opinion piece, a letter to the editor, or a blog is open to anyone in the community. Just remember to keep your comments civil. We won’t publish personal attacks.

Regarding the particular issue of tax-abatement for the Lee-Meadowbrook project, Fran’s blogs and other opinion pieces on the topic raise several questions that I hope the BOE will examine:

1) Is 80% for 11 years the appropriate amount of tax abatement? It was the same amount that the BOE approved for a similar project (which did not move forward) several years ago, but has the market changed? Could we give a lower amount of abatement for a shorter term and still get the project done?

2) Can we put performance benchmarks in the terms of the agreement? By giving the abatement, we are assuming some of the risk to get the projected benefits. If the projected revenues turn out to be too optimistic, can we adjust the abated amount?

3) Can we craft incentives for owners of existing buildings in the surrounding area to improve their properties? There are several vacant storefronts in the Cedar Lee area, and not all of the properties are well-maintained (although several are!). How can we leverage this new investment to create a catalyst for even greater things for the Cedar Lee Business District and the city as a whole?

I wish that the CH city council would have examined the issues Deanna Bremer Fisher brings up in her comment *before* certifying the proposal for the BOE’s approval.

The “benefits” described in the Economic Impact Statement and the presentation to the BOE are simply unattainable. They are a fantasy.

Too bad the FutureHeights board members that wrote their favorable opinion pieces overlooked that. And lots more. All they needed to do was contact me. I begged them to, via my contact at the Heights Observer. To no avail.

————

From the comment above:

“Regarding the particular issue of tax-abatement for the Lee-Meadowbrook project, Fran’s blogs and other opinion pieces on the topic raise several questions that I hope the BOE will examine:

1) Is 80% for 11 years the appropriate amount of tax abatement? It was the same amount that the BOE approved for a similar project (which did not move forward) several years ago, but has the market changed? Could we give a lower amount of abatement for a shorter term and still get the project done?

2) Can we put performance benchmarks in the terms of the agreement? By giving the abatement, we are assuming some of the risk to get the projected benefits. If the projected revenues turn out to be too optimistic, can we adjust the abated amount?

3) Can we craft incentives for owners of existing buildings in the surrounding area to improve their properties? There are several vacant storefronts in the Cedar Lee area, and not all of the properties are well-maintained (although several are!). How can we leverage this new investment to create a catalyst for even greater things for the Cedar Lee Business District and the city as a whole?”